In the volatile world of finance, the stock market highest point represents a significant milestone for investors and market enthusiasts. It is the peak where the stock market's performance has reached an unprecedented level, often triggering a mix of excitement and cautious optimism. This article delves into the factors contributing to these record highs, the implications for investors, and the future outlook.

Historical Stock Market Highs

Over the years, the stock market has witnessed several all-time highs. One of the most notable instances was in 2017 when the S&P 500 reached an all-time high of 2,872.02. This milestone was followed by another high in 2018, reaching 2,938.10. These record highs were primarily driven by factors such as strong economic growth, low unemployment rates, and favorable monetary policies.

Factors Contributing to Record Highs

1. Economic Growth

Economic growth is one of the primary factors contributing to stock market highs. When the economy is performing well, businesses tend to generate higher profits, leading to increased investor confidence. This positive sentiment drives stock prices higher, ultimately reaching new all-time highs.

2. Low Unemployment Rates

Low unemployment rates indicate a healthy job market, which, in turn, boosts consumer spending. As consumer spending increases, businesses experience higher revenues, leading to improved financial performance. This improved performance is reflected in higher stock prices, contributing to record highs.

3. Favorable Monetary Policies

Central banks play a crucial role in shaping the stock market. When central banks adopt favorable monetary policies, such as lowering interest rates or implementing quantitative easing, it tends to boost investor confidence and drive stock prices higher.

4. Technological Advancements

Technological advancements have been a major driver of stock market highs. Companies operating in the tech sector, such as Apple, Amazon, and Microsoft, have seen significant growth, contributing to the overall market's performance.

Implications for Investors

The stock market highest point presents both opportunities and challenges for investors. Here are a few key implications:

1. Buying Opportunities

For investors looking to buy stocks, the stock market highest point can be an excellent entry point. By investing in well-performing companies, investors can potentially benefit from their growth in the long run.

2. Selling Opportunities

For investors looking to sell their stocks, the stock market highest point can be an ideal time to cash in on their investments and secure profits.

3. Risk Management

Investors must be cautious of potential market corrections, as record highs can be followed by periods of volatility. Implementing a robust risk management strategy is crucial to navigate these challenges.

Future Outlook

The future outlook for the stock market highest point remains uncertain. While economic growth and technological advancements continue to drive market performance, factors such as geopolitical tensions and trade disputes can pose challenges. As such, investors must remain vigilant and stay informed about market trends and economic indicators.

Case Studies

1. Apple Inc.

Apple Inc. has been a major contributor to the stock market highest point. The company's innovative products and strong financial performance have driven its stock price higher, reaching an all-time high of $207.05 in February 2021.

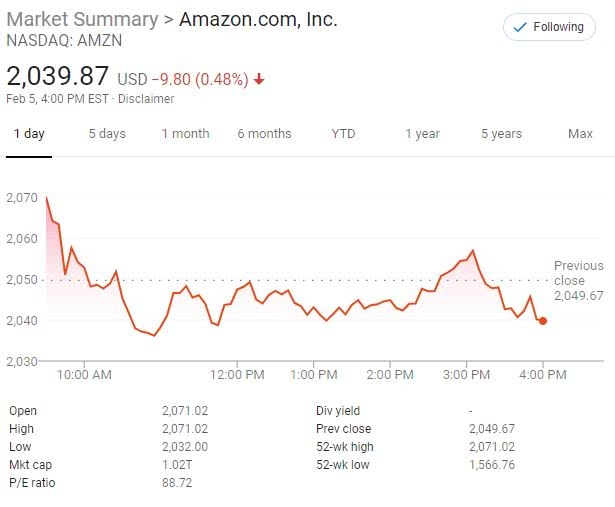

2. Amazon.com Inc.

Amazon.com Inc. has also played a significant role in the stock market highest point. The e-commerce giant's continuous expansion into new markets and its impressive financial performance have contributed to its stock price reaching an all-time high of $3,611.89 in February 2021.

In conclusion, the stock market highest point represents a significant milestone for investors and market enthusiasts. By understanding the factors contributing to these record highs and the implications for investors, one can make informed decisions in the volatile world of finance.

can foreigners buy us stocks